H.R. 2656: A Closer Look at the Trigger Leads Abatement Act of 2023

Purchase Application Data In 2023, the Trigger Leads Abatement Act (H.R. 2656) was introduced in the United States. This law generated debates and discussions across the country regarding the buying and selling of trigger leads in the financial industry. Let’s explore the details of H.R. 2656, its objectives, and its possible effects on consumers and […]

Read More

Housing Market Shortage: The Root Causes and What You Need to Know

In January 2023, the US housing market experienced a severe shortage of homes, with only 1.6 months’ supply available – a historic low. Although there has been a slight increase in the number of homes on the market, the demand from buyers greatly surpasses the available inventory. As a result, this scarcity has led to […]

Read More

How Borrowers benefit from a 1031 Exchange

Investing in real estate can be highly profitable but also comes with challenges. One major obstacle is managing taxes when selling investment properties. However, investors who understand capital gains tax can leverage the power of a 1031 exchange to their advantage. So, what exactly is a 1031 exchange? It’s a provision in the United States […]

Read More

Is the Claim of an Unfair Mortgage Rule on Borrowers With High Credit Scores True?

News outlets recently reported a rule focusing on mortgage borrowers with higher credit scores. The reality is that changes are being made to the Loan-Level Price Adjustments (LLPA) matrix by the Federal Housing Finance Agency (FHFA) in May 2023 to address housing affordability challenges in the US. The LLPA matrix applies pricing adjustments to base […]

Read More

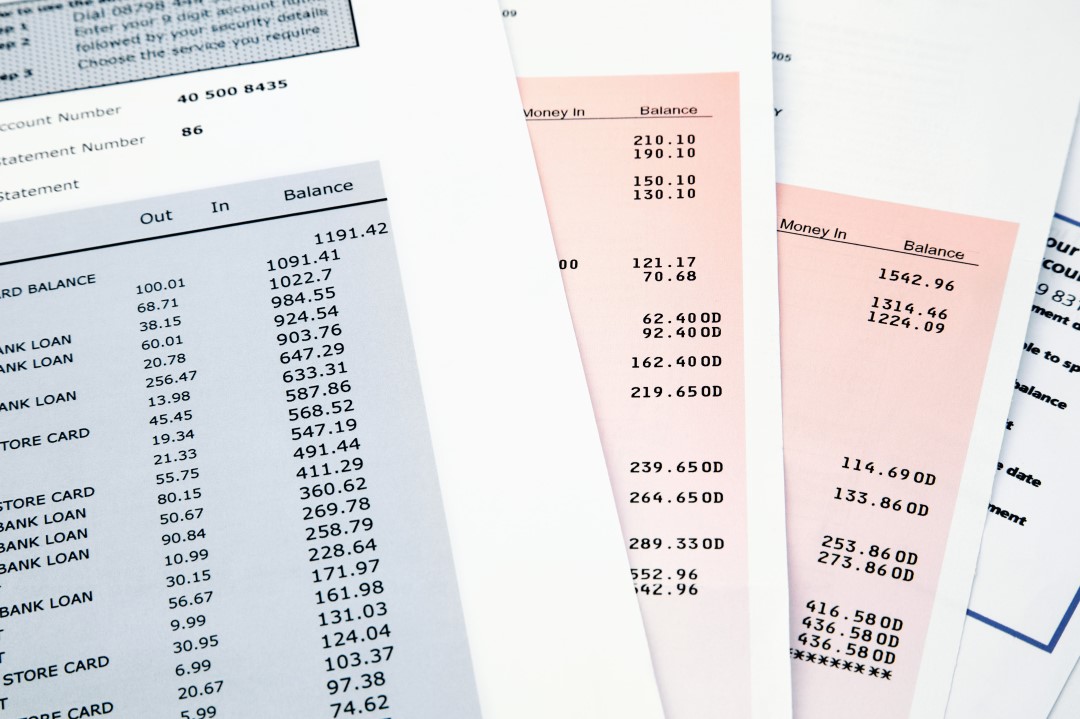

Why Entrepreneurs Benefit From Using Bank Statement Loans

According to Legal Zoom, there are 31 million entrepreneurs in the U.S. Unfortunately, self-employed borrowers looking to purchase a primary, second home, or investment property face varying challenges when trying to obtain a mortgage with conventional lenders. Traditional lenders often turn down good borrowers despite their ability to afford the monthly housing costs. For this […]

Read More

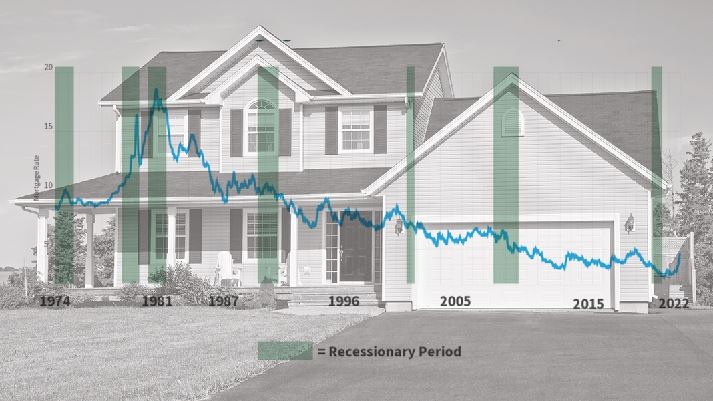

How Fluctuating Mortgage Rates Affect the Housing Market

In 2020, interest rates were at an all-time low. This made it possible for borrowers to buy larger homes or refinance their current property at a lower rate. However, all-time low-interest rates could not last forever. By January 2022, interest rates began to increase, limiting borrowers’ purchasing power and eroding the refinance market. Mortgage and […]

Read More

Why Self-Employed Borrowers Embrace Bank Statement Loans

What is a bank statement loan, and who benefits from it? A bank statement loan is a type of loan that allows a borrower to qualify for a mortgage using only their personal or business bank statements as documentation for their income. Today’s tax codes allow entrepreneurs to write off business expenses. Although reducing tax […]

Read More

Why Non-QM Loans Are Not The Same As Subprime loans.

Today, Non-Qualified or Non-QM loans are growing in popularity, but there’s some confusion about what they really are. Let me start with the elephant in the room, they are not the same thing as subprime loans. Non-QM loans are a great solution for brokers to consider in helping those customers qualify for loans they otherwise […]

Read More

Non-QM Is Set To Reach $80 Billion In Loan Originations In 2022

Are you leaving money on the table by only offering agency home loans? Non-QM loans have been increasing in demand since their inception in 2015. As a result, Non-QM is set to reach $80 billion in loan originations in 2022. Non-QM is predicted to double and gain 10% of the mortgage market this year. This […]

Read More

Borrowers May Be More Suited For Non-QM Loans In Today’s Soaring Housing Market.

Brokers who offer conforming and high-balance loan products may be feeling lighter in the pocketbook with today’s soaring home prices. 2022 California Conforming limits are as high as $970,000 for a one-unit property based on FHFA House Price Index Report. A typical home value in California is $745,000 Zillow Indicated, a 20.5% increase over the […]

Read More