Housing Market Shortage: The Root Causes and What You Need to Know

In January 2023, the US housing market experienced a severe shortage of homes, with only 1.6 months’ supply available – a historic low. Although there has been a slight increase in the number of homes on the market, the demand from buyers greatly surpasses the available inventory. As a result, this scarcity has led to […]

Read More

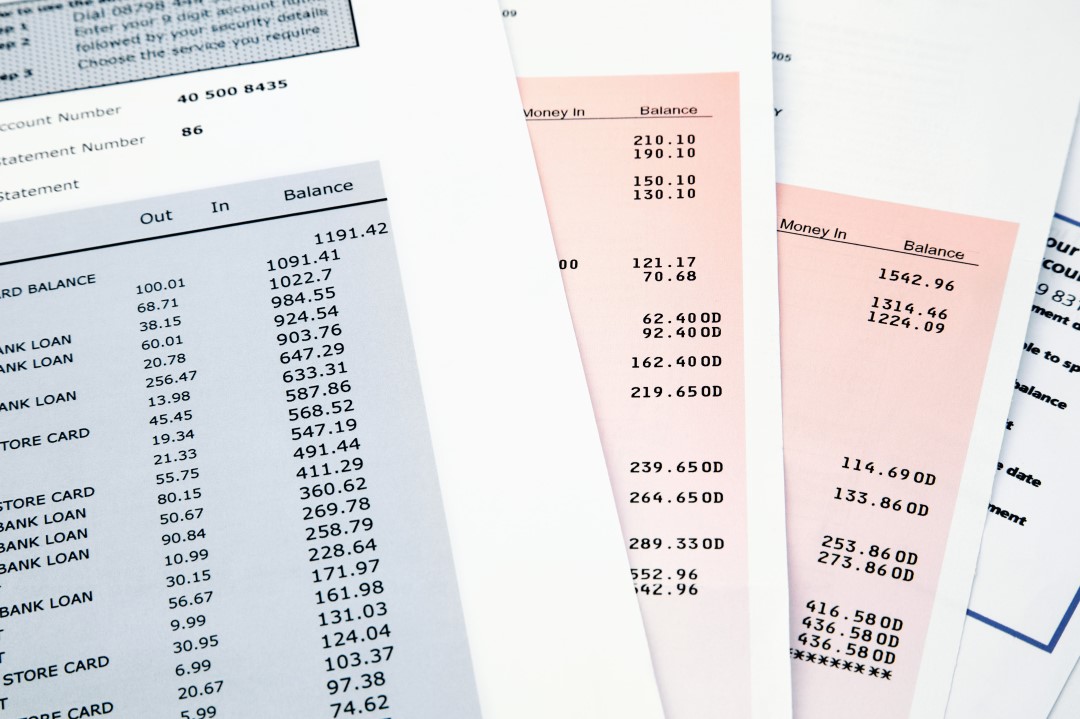

Why Self-Employed Borrowers Embrace Bank Statement Loans

What is a bank statement loan, and who benefits from it? A bank statement loan is a type of loan that allows a borrower to qualify for a mortgage using only their personal or business bank statements as documentation for their income. Today’s tax codes allow entrepreneurs to write off business expenses. Although reducing tax […]

Read More

How young professionals are becoming homeowners with Non-QM loans.

How young professionals are stepping into homeownership despite having student loans A recent trend shows that young professionals from ages 25 to 35 are delaying homeownership. Why? The most common answer is increasing student loan debt. This debt often excludes young professionals from homeownership due to conventional underwriting guidelines that impose debt-to-income restrictions they cannot […]

Read More

7 Terms to Understand When Taking Out a Non-QM Loan

As you may have found while looking for mortgage lenders in your area, some homebuyers don’t fall into the standard box for mortgage lenders. This can be for a variety of reasons, ranging from credit to income, and more. Potential homebuyers may even assume that they can’t even get a loan because they don’t know […]

Read More

Are Nonqualified Mortgages The Same as Subprime?

Subprime mortgages first gained popularity in the early 2000s. However, there’s a new type of mortgage loan out there building upon the success of subprimes. Non-qualified mortgages are not subprime, but they are similar as they do not conform to the typical underwriting guidelines of qualified mortgages. Non-qualified mortgages are a confusing topic for a […]

Read More

Self-employed? You May Still Qualify for a Non-QM Loan

Many Americans know how difficult it is to buy a home. This is especially true if you are self-employed. Little-known fact: for most lenders to give a self-employed individual a home loan, the borrower will need to prove at least two years of self-employment. Often, the typical mortgage loans are not designed for the self-employed, […]

Read More

Easier Bank Statement Loans Guidelines for the Self-Employed

Financial institutions operate under very stringent rules and regulations that keep watch of all activities and ensure financial stability. Advancing of loans has conventionally been a product of the employed with the self-employed getting subjected to lengthy process before their money is disbursed. New loan guidelines have brought solace as bank statement mortgage loans are […]

Read More

Self-Employed? Buy a Home with a Bank Statement Mortgage

If you are self-employed like many young people in this generation, you might be worried about getting a mortgage. Sadly, for most people who are self-employed, they are likely to miss out on obtaining a mortgage. However, you should not give up yet on getting a good mortgage deal, especially if you have dependable income […]

Read More

Insight about Non QM Loans

One of the significant accomplishments in a person’s life is to own a home. If you are not financially well-off, you can use a mortgage to purchase a home. There are various types of mortgages, and in this context, we will discuss about non-QM loans. For starters, non-QM loans do not follow the rules and […]

Read More