Why Entrepreneurs Benefit From Using Bank Statement Loans

According to Legal Zoom, there are 31 million entrepreneurs in the U.S. Unfortunately, self-employed borrowers looking to purchase a primary, second home, or investment property face varying challenges when trying to obtain a mortgage with conventional lenders. Traditional lenders often turn down good borrowers despite their ability to afford the monthly housing costs. For this […]

Read More

Why Self-Employed Borrowers Embrace Bank Statement Loans

What is a bank statement loan, and who benefits from it? A bank statement loan is a type of loan that allows a borrower to qualify for a mortgage using only their personal or business bank statements as documentation for their income. Today’s tax codes allow entrepreneurs to write off business expenses. Although reducing tax […]

Read More

Will Your Mortgage Lender Allow Gift Funds?

If you’re in the market to purchase a house, your most significant upfront expense is going to be the down payment. Having a sizable down payment isn’t always easy to accomplish, especially for first-time homebuyers. In many cases, people rely on money that was gifted to them to help make the down payment. This tends […]

Read More

Tips on Getting a Loan if You’re Self-Employed

Being self-employed has a lot of advantages. You have a more flexible schedule, but you also have to keep up with the administrative side of your business yourself. This is especially true when it comes to managing your own finances, which can make getting approved for a mortgage loan difficult. Lenders usually like to see […]

Read More

How to Compare Bank Statement Loans from Different Lenders

Smart borrowers know to shop around for their mortgage. Many lenders offer bank statement loans, but not all programs offer the same benefits. Knowing which one is right for you can be challenging, but it’s important to understand how to compare the terms, rates, and programs offered by each lender. The more you know, the […]

Read More

How to Use Non-Traditional Credit to Get a Mortgage

Finding your forever house can be difficult. What’s even harder is getting accepted for a loan to buy that dream house, especially if you have bad or no credit. That’s why many borrowers are looking to bank statement loans to help them finance their house. Mainstream mortgage lenders will not grant you a home loan […]

Read More

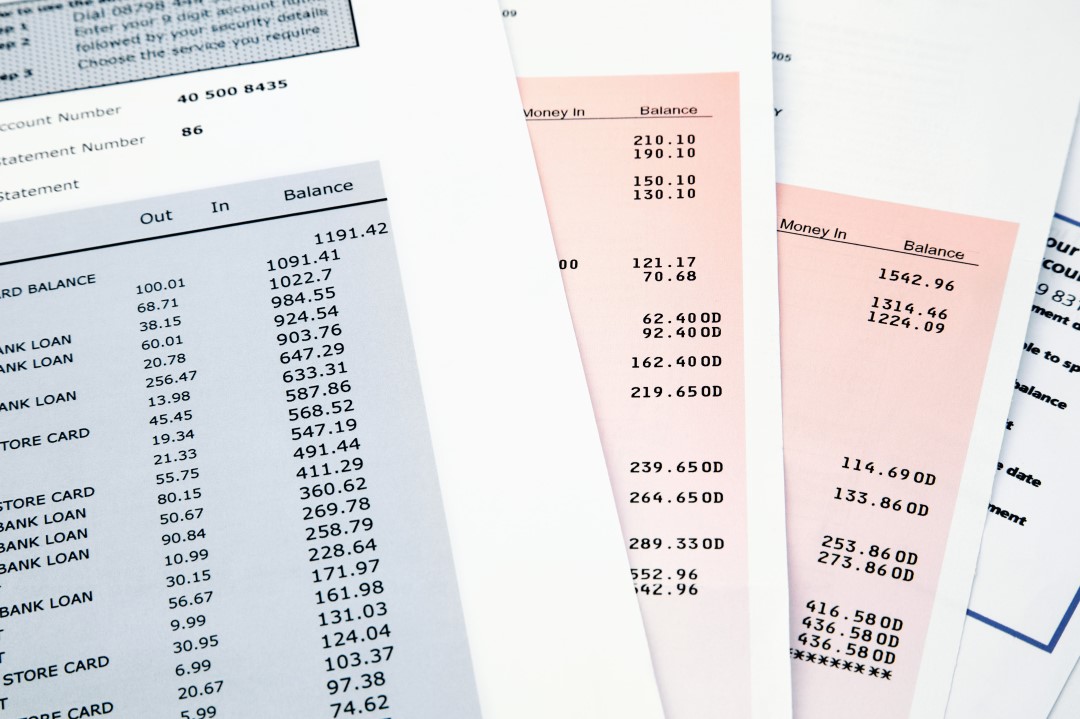

Things that mortgage lenders fear seeing on bank statements

Why lenders require bank statements One of the critical documentation that your lender might ask for during a mortgage loan application process is your bank statements. The mortgage lender uses the bank statements to assess and verify the borrower’s credit history and the ability to repay the loan on the specified period. The lender uses […]

Read More

Mishaps to look out for when applying for a mortgage loan

What are mortgage loans? Mortgage loans are a preferred method used by property and residential owners to secure loans to be used to raise funds to purchase or build real estate for or for any other purpose. The owner’s property or residential estate is used as collateral to secure the mortgage loan. The lender of […]

Read More

Who Needs Bank Statement Loans?

Bank Statement Loans is a program meant mostly for the self-employed. They buy and can refinance their homes without worrying about tax returns and provision of the extensive documentation. The small business owners, freelancers, entrepreneurs, and self-employed persons are advised to get a bank statement mortgage loan at a low-rate without being stopped due to […]

Read More

Why Lenders Want To See Your Bank Statements

Do you manage your money responsibly? If you know the financial weaknesses that are deal breakers for lenders, you can strengthen your chances of being given a loan. Mortgage lenders are trained to spot financial mismanagement, and they carefully review your application to decide whether to approve or deny you a home loan—your transaction history […]

Read More